Improperly denied mortgage modifications: During at least a seven-year period, the bank improperly denied thousands of mortgage loan modifications, which in some cases led to Wells Fargo customers losing their homes to wrongful foreclosures.In addition, the bank failed to ensure that borrowers received a refund for certain fees on add-on products when a loan ended early. The bank incorrectly applied borrowers’ payments, improperly charged fees and interest, and wrongfully repossessed borrowers’ vehicles. Unlawfully repossessed vehicles and bungled borrower accounts: Wells Fargo had systematic failures in its servicing of automobile loans that resulted in $1.3 billion in harm across more than 11 million accounts.

The CFPB’s specific findings include that Wells Fargo: It offers a variety of consumer financial services, including mortgages, auto loans, savings and checking accounts, and online banking services.Īccording to today’s enforcement action, Wells Fargo harmed millions of consumers over a period of several years, with violations across many of the bank’s largest product lines. Wells Fargo (NYSE: WFC) is one of the nation's largest banks serving households across the country.

This is an important initial step for accountability and long-term reform of this repeat offender.” “The CFPB is ordering Wells Fargo to refund billions of dollars to consumers across the country. “Wells Fargo’s rinse-repeat cycle of violating the law has harmed millions of American families,” said CFPB Director Rohit Chopra. Under the terms of the order, Wells Fargo will pay redress to the over 16 million affected consumer accounts, and pay a $1.7 billion fine, which will go to the CFPB's Civil Penalty Fund, where it will be used to provide relief to victims of consumer financial law violations. Wells Fargo also charged consumers unlawful surprise overdraft fees and applied other incorrect charges to checking and savings accounts. Consumers were illegally assessed fees and interest charges on auto and mortgage loans, had their cars wrongly repossessed, and had payments to auto and mortgage loans misapplied by the bank. The bank’s illegal conduct led to billions of dollars in financial harm to its customers and, for thousands of customers, the loss of their vehicles and homes. – The Consumer Financial Protection Bureau (CFPB) is ordering Wells Fargo Bank to pay more than $2 billion in redress to consumers and a $1.7 billion civil penalty for legal violations across several of its largest product lines. The use of any third-party trademarks, logos, or trade names are for informational purposes only and do not imply an endorsement by the owner.WASHINGTON, D.C. We recommend you review the privacy statements of those third party websites, as Chime is not responsible for those third parties' privacy or security practices.ġ Data pulled from Wells Fargo: Clear Access Banking Account Fees as of November 28, 2022: Ģ Data pulled from Wells Fargo: Everyday Checking Account Fees as of November 28, 2022: ģ Data pulled from Wells Fargo: Prime Checking Account Fees as of November 28, 2022: Ĥ Data pulled from Wells Fargo: Premier Checking Account Fees as of November 28, 2022: ĥ Data pulled from Wells Fargo: Consumer Account Fees and Information as of November 28, 2022: Ħ Data pulled from Wells Fargo: Wells Fargo Platinum Savings as of November 28, 2022: The privacy practices of those third parties may differ from those of Chime.

Wells fargo check book cost full#

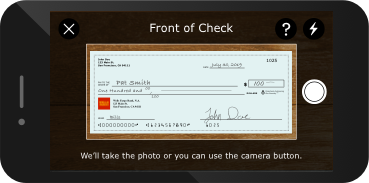

See your issuing bank’s Deposit Account Agreement for full Chime Checkbook details.īy clicking on some of the links above, you will leave the Chime website and be directed to a third-party website. While Chime doesn’t issue personal checkbooks to write checks, Chime Checkbook gives you the freedom to send checks to anyone, anytime, from anywhere. Please see back of your Card for its issuing bank. and may be used everywhere Visa credit cards are accepted.

Wells fargo check book cost license#

The Chime Visa® Credit Builder Card and the Chime Visa® Cash Rewards Card are issued by Stride Bank pursuant to a license from Visa U.S.A. and may be used everywhere Visa debit cards are accepted. or Stride Bank pursuant to a license from Visa U.S.A. The Chime Visa® Debit Card is issued by The Bancorp Bank, N.A. Banking services provided by The Bancorp Bank, N.A.

0 kommentar(er)

0 kommentar(er)